Taking control of credit card usage should be a priority in designing your path to financial freedom. Credit card debt is one of the highest personal debts people carry. The average national credit card balance in 2023 was $6,993, and the current average APR is 22.75%.

New to Credit Cards

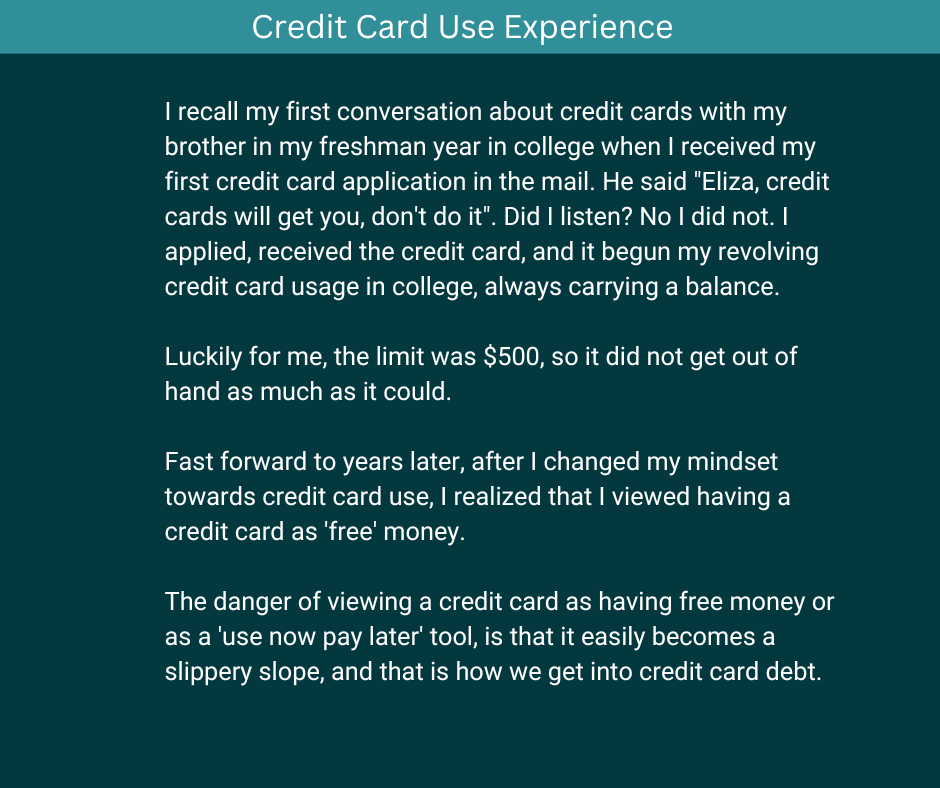

There are many reasons why people use credit cards. I remember applying for my first credit card in college and using it as soon as I received it. I didn’t have money to pay for how much I spent by the due date, but somehow I thought it was okay to carry a balance over and over again.

Credit card debt can quickly get out of hand, so if you are new to credit cards, be sure to develop a plan for credit card usage before you apply for one. Ask yourself these questions: What is your purpose for obtaining a credit card? Is it to build credit, for rewards and points, to make a big purchase, or to use for emergencies? Whatever the reason is, make sure you do your research, design your financial freedom goals and make sure your credit card usage aligns with your financial freedom goals (spending habits, income, savings goals etc.).

How Credit Cards Can Easily Get Out of Hand

Using a credit card almost always starts off with good intentions. You use a credit card and intend to pay it off by the due date. Except something else comes up and you can’t pay the full balance. For example, your car breaks down, and if you don’t have enough saved, so the car bill becomes the priority.

You end up paying just the minimum balance on the card, and charge part of the car bill to the credit card. Interest accrues for that month, and the balance increases. Month after month, this happens, and the balance continues to grow. Remember, you started with the best of intentions with the first balance, but using credit cards can be a slippery slope.

Create a plan with your credit card usage to avoid getting into credit card debt.

How to Avoid Credit Card Debt

Avoiding credit card debt should be your main goal when using a credit card. I have found the following tips useful in avoiding credit card debt.

Use a Budgeting Tool to Track Credit Card Usage

Including my credit card in my budgeting tool is one great way I have avoided credit card debt. Budgeting tools like YNAB are very effective in tracking credit card use. It helps in creating a visual of all your credit card spending and payment. If you are in credit card debt, the YNAB tool is a great tool to help you budget and pay down your debt.

An excel spreadsheet is also a good tool to use to track your credit card usage.

Use Your Credit Card as a Debit Card

Remember when I use to view a credit card as ‘free money’? Well, no more. After working on my mindset, I now use a credit card as a debit card, and I use it only for absolute necessities (no wants). I know people mention that they use their credit cards for everything and pay it off at the end of the month. Personally, I prefer to use it only for absolute necessities, because if I use it for ‘wants’, even though I already have it budgeted, I tend to spend more anyway.

To use a credit card as a debit card, I budget my expenses in YNAB budgeting tool app, use my credit card for a need such as a monthly bill or grocery. I then ‘assign’ the money to the credit card category to pay off the balance before end of statement balance or I pay it off immediately. I prefer the latter.

Set Up Auto Pay

I especially like the auto pay feature on credit cards. You are able to set autopay on your credit card, where any balance you are carrying will be paid off by a monthly date set by you. You can set up auto pay before or on the due date.

Tip: Call your credit card company if you miss a payment and assessed a late fee. If it is your first missed payment, the fee will most likely be waived. To avoid all this hassle, set auto pay on your credit card.

How to Pay Off Credit Card Debt

If you have credit card debt, I recommend the following steps to get rid of credit card debt as soon as you can.

Put a Plan in Motion

Log into all your credit card accounts and write down the balance for each card either on paper or on an excel/google sheet. Write down the minimum payments, due dates, and APR. This will give you a true picture of the credit card debt and how much interest you are accruing. Some credit card companies have a calculator on their site to help you determine how long it will take you if you pay only the minimum payment, and how much you will pay in interest.

There are also many credit card calculators online. You can use this calculator to determine how much interest you will pay on your credit card balance in a month. You have to know your credit card APR.

There are two ways you can tackle your debt, and whichever method you choose is up to you.

Avalanche Method and the Snowball Method

With the avalanche method, you will list your credit cards from highest APR to the lowest. Pay the minimum on each card every month, and add any extra money you have to the one with the highest APR. Keep going, till you pay all the cards off.

With the snowball method, list your debt from lowest balance to highest balance. Pay the minimum on each card every month, and add any extra money you have to the smallest balance.

Math tells us that we will pay less interest with the avalanche method, but to be honest with you, I prefer the snowball method because it feels motivating when you see an entire balance disappear from your spreadsheet no matter how small it is.

I recommend you do some calculations before you choose a method. If you believe the avalanche method will save you significant interest, then go for it. Otherwise, use the snowball method to keep you motivated.

Stick to Your Plan

I know this is easier said than done, but you really need to stick to the plan to pay off your credit cards. Having a visual when paying down debt is a great motivator. I have seen people put a large paper on a wall to mark down their debt payment. I have seen others use online graphs and apps to track their debt payment.

Do whatever it takes to keep your momentum going, because sometimes it gets difficult to keep going.

Let a close friend or family know about your debt repayment plan, so they can cheer you on. Join a Facebook group to stay motivated and learn about all the creative ways people are able to pay down debt.

Use Auto Pay

Using auto pay helps you stay consistent. It is easy to get tempted sometimes when you are on a long road to pay off credit card debt. Use auto pay to pay down what you have already earmarked for your credit card debt payment.

Side Hustle

This is one of my favorite things to do to get rid of debt. You can utilize the skills you already have to find a side hustle to help you pay down your debt.

Remember to take a break now and then to commend yourself on a job well done, whether you are less than half way to the finish line, half way to the finish line, or one tenth way to the finish line. You are still making progress.

Add Your Child to Your Credit Card as an Authorized User

I got a question from one of our community members asking if it’s advisable to put your child on your credit card as an authorized user. My answer is yes, and I have done just that. Putting your child on your credit card helps them build credit and gives them a great credit history. Even though your child is an authorized user, it doesn’t mean you have to give them a copy of the credit card.

Tip: The credit card company will send your child a copy of the card. Keep that card with you, and educate them on how to responsibly use a credit card.

Other Credit Cards

Store (Clothing, Furniture etc.)

I saved the ‘best’ for last, or is it the ‘worse’ for last? A store credit card is another type of card that can easily get you into trouble. Have you seen all the sale signs in the store windows, or all the excessive emails promising you more discount and/or points if you use your store credit card? Watch out for these, it is easy to get caught up in all the promises and get yourself into credit card debt.

Follow the same rules as you would a general credit card. If you choose to use a store credit card, budget budget budget. The average APR for store credit cards in 2024 is 28.93% (Bankrate survey).

0% Promotional Rates Credit Cards

Have you heard about these? ‘0% Intro APR for 15 months‘, ‘Pay no interest for 12 months‘ and so on.

0% promotional rates credit cards seem like the best idea at a glance. It is so easy to sign up for a 0% promotional rate credit card, with the intention to pay it off within the 12 or 15 months given. Afterall, it takes forever for a year to come around again right? No it doesn’t.

Many people as always have the best intentions to make consistent payments on a 0% promotional credit card, but end up not paying the balance before the promotional date expires. When this happens, you are charged a higher interest at the end of the promotional period.

Final Thoughts

If you find yourself in severe credit cared debt, contact your credit card company to speak with customer service. They might have a program where they decrease your interest rate or stop the interest rate from accumulating, so you can pay down your balance faster.

If you find that it is easy for you to overspend on your credit card, or you don’t pay your balance in full each month, I recommend you stop using your credit card for a period of time, revisit your budget and make sure you are including some fun money in there. Get your mindset in the right place before you start using the card again for budgeted necessities.

Everyday, take one step towards financial freedom, no matter how small or big that step is.

Tips From Our Community